Singapore Personal Tax for Non-Residents

Singapore Personal Income Tax for Non-Resident Employees

The employment income of a non-resident individual in Singapore is charged at the higher of:

- 15% on the gross amount (without any deduction for personal reliefs and contribution to provident funds); or,

- Corresponding tax under the resident basis.

Director’s fees, consultation fees & all other income

Income from other sources (unless exempted) will be taxed at a flat rate which is currently 20%. There is an exemption in respect of the employment income of a non-resident individual (other than a director or public entertainer) who does not exercise employment in Singapore for more than 60 days during the year.

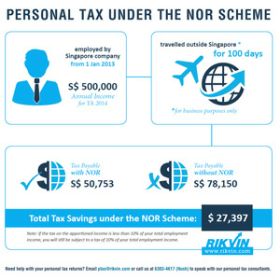

The Not Ordinarily Resident (NOR) Scheme

The Not Ordinarily Resident (NOR) Scheme extends favourable tax treatment to qualifying individuals for a period of five years of assessment, provided such individuals meet the following criteria:

- The individual must not have been a Singapore resident in the 3 consecutive years of assessment before the year he first qualifies for the NOR scheme; and

- The individual must be a tax resident for the year of assessment in which he wishes to qualify for the NOR scheme and must also be employed by a Singapore employer.

If you satisfy the above conditions and are accorded NOR status, you would be able to enjoy the following tax concessions:

Time-apportionment concession

- Applicable if you have spent at least 90 days outside Singapore for business and derived a minimum annual income of S$160,000 from Singapore employment in the preceding year. You will only pay income tax on the portion of your employment income (including all benefits-in-kind with effect from Year of Assessment 20## but excluding director’s fees and any income tax payable in Singapore that is borne directly or indirectly by your company) according to the time you spend in Singapore.

- Tax exemption of employer’s contribution to Non mandatory Overseas Pension Fund or Social Security Scheme

- Applicable if you derive a minimum annual income of S$160,000 from Singapore employment in the preceding year. The employer’s contribution to non mandatory overseas pension funds or social security schemes for non-citizens/ non-permanent residents of Singapore is tax exempt subject to NOR cap computed based on the contribution made by employer to the CPF for a Singapore citizen as required under the CPF Act and the employer does not claim deduction for the contribution.

Area Representative Scheme

By concession, an area representative is taxed in Singapore on a proportion of the total remuneration package corresponding to the proportion of working days spent in Singapore during the year. However, benefits-in-kind provided in Singapore are fully taxable.

To qualify as an Area Representative, you must satisfy these four criteria below:

- you work in the representative office of a non-resident employer;

- you are based in Singapore for geographical convenience;

- you are required to travel substantially as you performed your duties for the foreign employer; and

- your remuneration is paid by your foreign employer and not charged to a permanent establishment in Singapore.

Under the Area Representative Scheme, even though your physical presence in Singapore might be less than 183 days in a calendar year due to substantial travelling, if your employment is a continuous period of at least 183 days straddling two years (under the two-year administrative concession) or if your employment in Singapore covers three continuous years (under the three-year administrative concession), you will be considered as a tax resident in Singapore for each year.

Dual Contracts

Alternatively, if you are working for a group of companies, it may be possible to have a separate contract of employment for duties to be performed wholly outside Singapore (in respect of a non-resident employer) with a view to exclude the earnings from that offshore employment from Singapore tax.

The IRAS routinely questions whether the duties performed inside and outside Singapore are genuinely separated and whether there are commercial and economic justifications for dual employment contracts. Therefore, these and other points would have to be considered in assessing whether separate employments would be justifiable. It is expected that most people who have a bona fide reason for a split contract should qualify under The Not Ordinarily Resident Scheme (see below). For this reason, it is anticipated that the IRAS will closely scrutinise dual contract arrangements implemented after the introduction of the Not Ordinarily Resident Scheme in the Year of Assessment 2003.

Letter of Guarantee (LOG)

A foreign individual who is employed by a foreign employer (e.g. representative office or entity not registered in Singapore) is required to provide LOG from a local bank or an established limited company in Singapore to cover his / her estimated tax for the coming Year of Assessment. If the LOG is not provided to the IRAS, an advance assessment will be issued.

If you are leaving Singapore or changing jobs

If you are about to leave Singapore or changing to another job within Singapore, your current employer needs to notify IRAS and ensure that you settle all your taxes before you go. This process is known as tax clearance. If you have any existing stock options or awards on hand which have yet to be exercised or vested, you will be deemed to have derived gains from the stock or awards at the point of tax clearance.

Tax clearance for non-citizen employees

Form IR21 must be completed at least one month before a non-citizen employee ceases employment in Singapore (including posting to an overseas location) or plans to leave Singapore for more than 3 months. Employers who fail to comply may be liable to a fine not exceeding $1,000 and for the employee’s unpaid tax, if any.

Need Assistance to meet with your Personal Tax Compilation and Filing?

Rikvin can assist you in your Singapore personal income tax filings. Our personal tax filing services include:

- Registration for new tax payers

- Preparation and filing of income tax return based on your income and determination of possible deductions and reliefs that are applicable to you

- Request for extension of deadline, if necessary

- Preparation of Form IR8A/IR21 for employees

- Tax planning and tax advice

- Year of Assessment & Basis Period

- Tax Residency & Personal Reliefs

- Source of Employment Income

- Double Taxation and Exemption

- Taxation of Different Types of Bonus

- Taxation of Allowances & Benefits-in-kind

- Taxation of Equity Gains

- Taxation of Director’s Remuneration/Fees

- Payment & Refund of Tax

- Special Schemes – NOR, Area Representative

- Employer’s & Employee’s Obligations: Forms IR8A, IR21 & B1

- Tax Compliance: IRAS Enforcement Actions on Non-Filing & Late Payment, Penalties for Negligence & Evasion

- Voluntary Disclosure

Disclaimer: The information contained in this website is for general reference only. While all reasonable care has been taken in the preparation of this information, Rikvin cannot accept any liability for any action taken as a result of reading its contents without further consulting us with regard to all relevant factors.

Need help filing your personal taxes online?

Let us do the work for you. With Rikvin, personal tax filing is done right and well before the deadline.